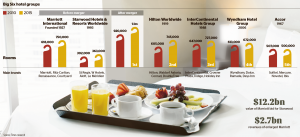

The hotel map of the world looks set to be redrawn after Marriott International wrong-footed its rivals yesterday to seal the $12.2 billion acquisition of Starwood Hotels & Resort Worldwide, the owner of the Sheraton and Westin brands.

The deal, which would create the world’s biggest hotel company with revenues of $2.7 billion, caught the market on the hop, as recent speculation had suggested that Hyatt Hotels Corporation was close to grabbing Starwood. Three Chinese suitors also were thought to be in the wings.

Shares of InterContinental Hotels Group, the FTSE 100 owner of Holiday Inn and Crowne Plaza, fell by 48p to close at £24.61 amid fears that the British group could struggle to keep up with its more aggressive global hotel industry rivals unless it decided to join the merger fray.

In July, IHG had been tipped as a bidder for Starwood and there were strong suggestions that it briefly considered making an offer. However, by the time it was forced to clarify its intentions by the Takeover Panel, it had withdrawn its interest and issued a statement in which it said that it was “not in talks with Starwood with a view to a combination of the businesses”.

A few days ago, IHG was forced to issue another formal rebuttal, this time to rumours that it was seeking to engineer a sale or merger with one of its rivals. However, Jamie Rollo, a Morgan Stanley analyst, said that Marriott’s move “could encourage IHG to reconsider” its stance.

Starwood effectively put itself on the block in April when it announced plans to “explore a full range of strategic and financial alternatives to increase shareholder value”, declaring: “No option is off the table.”

The surprise move came after the abrupt resignation in February of Frits van Paasschen as chief executive of Starwood. He was deemed to have been slow to expand into new markets or develop brands to boost the company’s growth potential in existing markets.

Under the cash-and shares deal announced by Marriott yesterday, Starwood shareholders will own 37 per cent of the enlarged company’s stock. Of the $12.2 billion purchase price, $11.9 billion will be in paper and $340 million in cash.

Starwood investors separately will receive $1.3 billion from the previously announced spin-off of the company’s timeshare business and its subsequent merger with Interval Leisure Group. Marriott, which runs the Grosvenor House Hotel on Park Lane under its upmarket JW Marriott brand, is expecting to deliver at least $200 million in annual cost savings. It said that it planned to continue Starwood’s programme of selling its owned hotels over the next two years, generating an estimated $1.5 billion to $2 billion.

As well as accelerating the expansion of Starwood’s brands, Marriott said that it would use the strong cash generation of the combined business to return at least $2.25 billion to its investors in dividends and share buybacks.

The enlarged group will have more than 5,600 hotels with a total of 1.1 million rooms.

Wouter Geerts, travel analyst with Euromonitor International, said: “The planned acquisition will make the combined company the uncontested top hotel player.”

Until recently, Marriott had given apparently clear signals that it was interested only in bolt-on deals rather than transformational mergers. When asked at an industry conference in May whether he would look at Starwood, Arne Sorenson, the Marriott chief executive, all but knocked down the idea: “Either Marriott or Hilton acquires them, they acquire someone else equally strong, they receive a buyer from the Middle East or Asia who wants a platform or they sell off real estate or get a new chief executive,” he said. “They are all potentially likely outcomes, except perhaps the first one.”

Mr Sorenson claimed yesterday that when Starwood had launched its strategic review, Marriott had “joined in and took a quick look at the information available and decided we were not going to go after this thing. In the months that followed we began to think about the value that could be made from pulling these two companies together.”

Although surprised, analysts said that the acquisition of Starwood by Marriott made strong strategic sense.